Scams and Fraud

In the last year, with Covid restrictions in place and daily human contact being ever more scarce, older people have become the victims of abuse in startlingly higher numbers. Abuse can sadly come in many different forms; physical, emotional, sexual and financial being just some of them.

At Age UK Oldham, we believe that everybody deserves the right to feel happy, safe and valued in their home, workplace and communities. We would like to raise awareness of this often-hidden cruelty and make sure people show love, kindness and compassion to the older people in their lives.

One type of financial abuse which has seen a dramatic rise is SCAMS or FRAUD. In the last year, there has been a 400% rise in reported cases alone. Scams are a way of cheating people out of their money. The people who operate them are sometimes called fraudsters, swindlers or con artists.

A scammer may try to approach you on your doorstep, by post, over the phone or online. They’ll often pretend to be someone they’re not, or make misleading offers of services or investments. You can protect yourself by knowing what to look out for, and what to do if you suspect a scam. The information on this page aims to keep you and those around you safe. Knowledge is your weapon!

SCAMS - Some of the facts...

(provided by Th!nk Jessica)

-

Scams cost the UK economy £5-10 billion a year

-

Only 5% of victims make a report

-

53% of over 65s have been targeted by scams

-

There is no typical victim. There is a scam for everyone if they are hit at the right time, with the right scan

-

Scammers will continue to come up with new and more convincing ways of parting people with their cash, of getting them to disclose personal information

Thankfully there are a number of organisations out their whose purpose it is to safeguard the public against scammers and educate us on what to look out for and how to avoid them.

Action Fraud

Action Fraud is the UK’s national reporting centre for fraud and cybercrime where you should report fraud if you have been scammed, defrauded or experienced cyber crime in England, Wales and Northern Ireland.

You can report fraud or cyber crime using their online reporting service any time of the day or night; the service enables you to both report a fraud and find help and support. They also provide help and advice over the phone through the Action Fraud contact centre. You can talk to the fraud and cybercrime specialists by calling 0300 123 2040.

Age UK

Age UK give a wide range of advice on how to protect yourself and your money from scammers. This can be found on their website and also within this useful booklet. They promote the message about how important it is to talk to someone you trust if you think you are facing a potential scam, or to speak to someone you if you think they are being scammed.

Th!nk Jessica

This booklet's aim is to inform you about the tricks scammers use, and how you can keep safe. It covers postal, phone, internet and doorstep crime and contains a helpful directory of agencies, organisations and charities which offer help, support and advice.

The booklet was written by Marilyn Baldwin OBE whose mother succumbed to scammers, the stress and turmoil of which is believed to have added to her death years later. In this time she'd sent thousands of pounds to scammers and become brainwashed by the sheer volume and content of the mail she received. At the time of her death in 2007, her daughter removed 30,000 scam letters from her home.

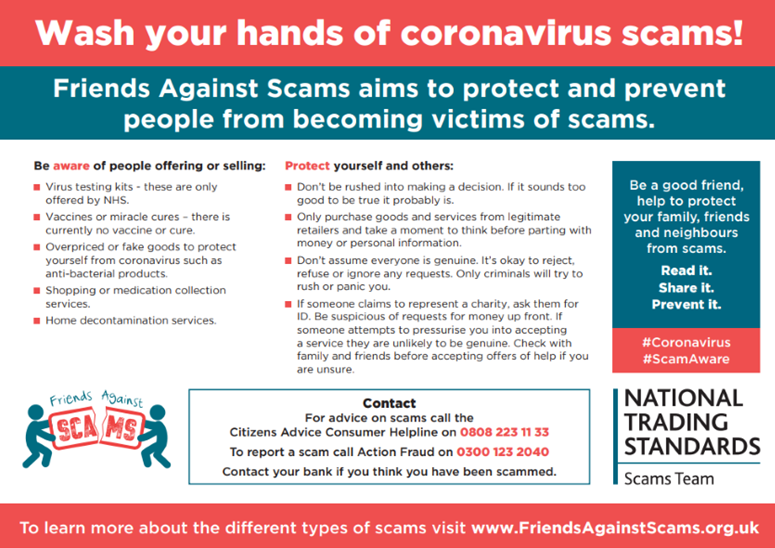

Friends Against Scams

Friends Against Scams is a National Trading Standards Scams Team initiative which aims to protect and prevent people from becoming victims of scams by empowering people to take a stand against scams.

Friends Against Scams is designed to inspire action, highlight the scale of the problem, change the perceptions of why people fall for scams and make scams a community, regional and national topic.

By attending a Friends Against Scams awareness session or completing the online learning, anyone can learn about the different types of scams and how to spot and support a victim. With increased knowledge and awareness, people can make scams part of everyday conversation with their family, friends and neighbours, which will enable them to protect themselves and others.

Anyone can be a Friend Against Scams and make a difference in their own way.

They have produced the below information particularly about Covid related scams:

As well as all the national organisations, information and helplines provided, Age UK Oldham run many services which can help keep you safe and make sure you’re relying on someone you know you can trust.

Choosing the Right Care

Our independent advisor can give information on CQC Registered Home care companies that provide support in the Oldham area. Pre-pandemic the advisor facilitated home or onsite ward visits at the Royal Oldham Hospital, Butler Green and Medlock Court in order to facilitate patients and their carers at the earliest intervention. This proactive approach prevents older vulnerable people succumbing to bogus Home Care companies.

The advisor also supports and informs people of the private costs involved, can provide information on the financial thresholds for support via OMBC and can refer into them if needed. The advisor can discuss benefits support and makes sure that clients are claiming all the benefits they are entitled to. If a client is more financially stable, they are less likely to fall victim to bogus financial companies.

Ambition for Ageing

Bringing together older people within community groups to help reduce isolation: within these groups and community settings awareness of scams can be promoted, talks can be given, and relationships built with local PCSOs.

Dementia Infomration and Support Service

The Advisor can help clients find out about services locally and nationally and provide clients with one-to-one emotional support, give access to a range of useful resources, help to plan for the future, connect clients to services that can support them and explain what financial help is available to clients and their carers. If a client is more financially stable, they are less likely to fall victim to bogus financial companies. They are also less vulnerable if they are receiving the appropriate care and if they have a good support network within their local community.

Information and Advice / Money and Benefits

We are a trusted name in the community and make ourselves visible and approachable to members of the public, who contact us regarding a wide range of issues.

This service provides a basic benefit check. Enabling a person to claim money they are entitled to, making them more financially secure makes them less likely to succumb to quick loan companies with high APR rates. We also provide referrals to the local Citizens Advice Bureau and Welfare Rights Team which can aid with making a client more financially secure and able to manage debt appropriately. If clients ring up with suspicions of a scam, we can support them to follow this up. We report any scams as financial crime to Action Fraud, an online crime reporting system. If a client is a safeguarding concern, we always follow this up with a report to the Multi Agency Safeguarding Hub. We can also make in-house referrals to further support clients, for example to the AUKO PIP Service.

Oldham Prevention Alliance

Membership of Oldham Prevention Alliance is free and is open to statutory, voluntary and private sector organisations and community groups working with the over 50s. Members are invited to attend regular informal meetings and to be part of an informative email network.

They meet every two months and send out information updates to keep people up to date with changes and developments. This can include promoting awareness of scams in local areas and forming connections with local PSCOs.

Promoting Independent People Service

The PIP Service is a preventative service that reduces social isolation and enables older people to live a more independent life. The PIP Service is therefore connected to many community groups, Social Care Teams, GPs, District Nursing Teams, Social Prescribing Teams and Council District Teams. This also enables connections with Housing Representatives, local policing, Care companies, Helpline and many other services that older people utilise. If a scam is known to be circulating in an area, PIPs can share this information with the above groups to promote awareness and prevent older vulnerable people becoming victim to scams.

The PIP Team support older people to live independently within their own home for longer. This could include employing domestic staff and carers. Only companies that are certified and DBS checked are promoted for use with clients.

If a client has fallen victim to a scam the PIP Advisor would support them with the process of reporting the crime, contacting their bank and make a referral to Multi Agency Safeguarding Hub, if appropriate.

PIP Advisors always wear ID and a uniform when visiting a client and remind clients to ask for ID when someone they don’t know calls to their door.

Where possible the PIP Advisor calls the client beforehand to arrange visits.

If possible they visit in pairs if cold-calling.

PIP Advisor working within Oldham Rapid Community Assessment Team

The Advisor can communicate scam alerts or scam information to the cluster teams to raise awareness (including with ICET/Helpline/Enablement teams) via presentations, team group emails and word-of-mouth. The Advisor has excellent team working with ICET, if health/enablement staff notice anything of concern they often refer to the Age UK PIP Advisor to support older, vulnerable people. The advisor has undertaken safeguarding training and reports safeguarding concerns in accordance with organisational policy. The Advisor will always use ID and uniform when visiting and remind clients to ask for IDs when someone they don’t know calls to their door. Where possible the Advisor will call the client beforehand to arrange visits. If possible they visit in pairs if cold-calling

Technology and Us

This service provides IT lessons to older people. The teacher supports the clients to set up online banking and Paypal accounts wish is the safest way to make online payments and shop safely. The teacher also gives the client an Age UK booklet on how to keep safe online. Also, any issues that clients wish to discuss regarding online scams and online safety is discussed openly within sessions. The teacher is DBS checked and is trained in safeguarding.

Befriending

-

All of the volunteers are DBS checked and extensively trained. The volunteers are aware of safeguarding and would report anything of concern back to the Befriending manager for her to act upon. The availability of this service helps prevent vulnerable lonely people succumbing to financial abusers.

Day Care Services including Enhanced Lunch Clubs and Meal Deliveries

All staff are extensively trained and aware of safeguarding and would act upon anything of concern, reporting to the appropriate authority. Staff have excellent relationships with clients and their families and would discuss openly with them any local scams that were known in the area. Leaflets and talks are given regularly related to scam awareness and staff regularly make scams a point of discussion. Staff are aware of vulnerable clients and safeguarding signs to look out for.

Mobility Service

-

Sells reconditioned and new mobility equipment. The aim is to promote independent living by providing impartial and expert advice on daily living equipment and related services. Clients can buy from this service trusting the Age UK Oldham name and thus prevent older vulnerable people from being susceptible to overpriced equipment that is not fit for purpose.

Life Story

All staff are extensively trained and aware of safeguarding and would act upon anything of concern, reporting to the appropriate authority. Staff have excellent relationships with clients and their families and would discuss openly with them any local scams that were known in the area. Staff are aware of vulnerable clients and safeguarding signs to look out for.

Shopping Delivery and Safe at Home

-

Since Covid, the Shopping Service Staff have been ringing people to take card payment over the phone. Every client has a password which two shopping service staff would use when ringing them to take card payments over the phone. This enables the client to feel confident it is definitely AUKO.

The Shopping Service staff have also started taking the previous weeks payment before taking their next shopping order, this is another way of the clients knowing its AUKO ringing.

Prior to Covid, staff would be in two’s whenever possible, especially when handling cash. Staff wear uniform and ID, the Shopping Service van has Age UK Oldham signage on so clients are confident to let staff into their homes.

Clients have a regular day for their phone call to give their order, delivery day and a similar time slot. Preventing any confusion with bogus callers or nuisance phone calls etc.

ALL concerns are reported back to the Line Manager regarding safeguarding issues to document and pass on or report where necessary. Staff have a concerns sheet on the back of the delivery/run sheets for the driver to make notes to report back.

HandyVan Service

The type of repairs that the scheme covers include DIY jobs and maintenance. We also have a number of contractors who work for AUKO providing a plumber, a registered builder, gardener and a qualified Gas engineer.

All our Handyworkers are experienced and trained to complete our range of tasks. All staff, including Assessors (for fitting of mobility equipment), are DBS checked.

Staff wear uniform and ID, the HandyVan has Age UK Oldham signage on so clients are confident to let us into their homes.

All contractors are asked to wear ID and a password can be requested by the customer.

If the client requests a service, we cannot provide we always refer them to the Tradesafe website. If they are unable to access this themselves we can provide a list of at list three traders from the list but always ask that the client requests more than one quote before entering into a decision of which tradespersons to use. We can help advocate for people who have no one else to help them.

This service prevents older vulnerable people falling victim to ‘cowboy’ builders and bogus tradespeople. If this has happened in the past the HandyVan Service Manager contacts the Tradesperson used and follows this up as appropriate. Often referring to MASH and GMPF when appropriate.