Your donations go further with Gift Aid

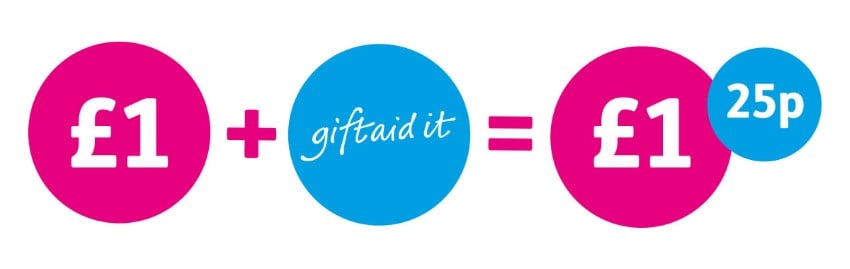

Your donations to Age UK North Worcestershire could be worth 25% more - at no extra cost to you - when you Gift Aid it!

What is Gift Aid?

- Gift Aid is a scheme that allows charities to claim back the basic rate tax on donations, which means we get more out of the money you give to us

- When you give money to Age UK North Worcestershire under Gift Aid, we will reclaim basic rate tax on that money – currently 25 pence to the pound. If you are a UK taxpayer, this means that £1.00 would be worth £1.25 just so long as donations are made through Gift Aid

- This also applies to items you donate to our charity shops. For every £1 we make from selling your items, Gift Aid gives us an extra 25p.

Imagine what a difference that could make and at no extra cost to you!

Do I qualify for Gift Aid?

To qualify for Gift Aid:

- You need to be a UK taxpayer

- You need to have paid or expect to pay enough UK income/capital gains tax in the tax year your gift was received to cover all the Gift Aid donations you made to charity that year

- You need to make a Gift Aid declaration

- If you are completing an enduring Gift Aid declaration, you also need to be sure you paid enough tax to cover the donations you made in the previous four years

How do I make a Gift Aid declaration?

- In our shops - If you are donating items to our shops, all you have to do is complete our short Gift Aid form as you drop off your items. Ask instore for more details

- When donating online - If you are donating money online, remember to tick the Gift Aid declaration box on the form

Frequently asked questions

What if my situation changes?

- Changes to your tax status, name, address, or dropping below the taxable threshold, can prevent us from claiming Gift Aid on your behalf. If you'd like to update your details, you can contact us on 01527 570490

I’m a pensioner. Do my donations qualify?

- Income from state pensions alone is unlikely to qualify as you’d need to earn above the personal allowance threshold to pay income tax. If this is your only source of income, we advise that you check with your tax office before completing a declaration

Do I need to renew my Gift Aid declaration each year?

- No, you only need to make a declaration once. We’ll keep this declaration as your enduring permission to claim Gift Aid tax relief on all donations. It will cover the previous four years, the current year, and any donations you might make to us in the future until you notify us otherwise

For more information, please visit the HMRC Gift Aid pages