What could you be entitled to?

Benefit rates have just been updated, so it's a good time to check you're not missing out on money you're eligible for.

Free to call 8am – 7pm 365 days a year

Find out more

Get a free weekly friendship call. We'll match you with one of our volunteers. Our service is flexible to suit the different needs of everyone who takes part.

Last year, over 10 million people trusted us to help them with some of the biggest issues in their lives. Learn more about how we help.

Here's how, with your support, Age UK is supporting older people through the cost of living crisis.

We hear from fundraiser Scott about how he got into running, and the grandfather who inspired him to support Age UK.

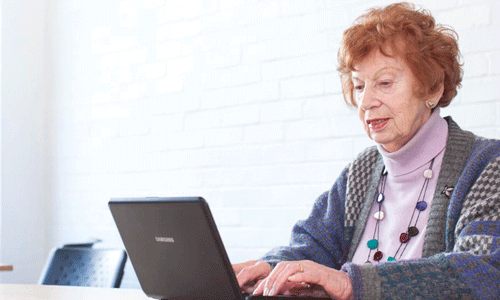

We visit Age UK Hammersmith & Fulham to find out how their classes are providing older people with digital know-how.

Caroline Abrahams, Charity Director for Age UK, discusses the five biggest priorities for older people from the next Government.

Terry, our Spring campaign storyteller, discusses the importance of knowing when to ask for support.

Call our free, confidential advice line on 0800 678 1602. We're open 8am-7pm, 365 days a year